kolarboat.ru Tools

Tools

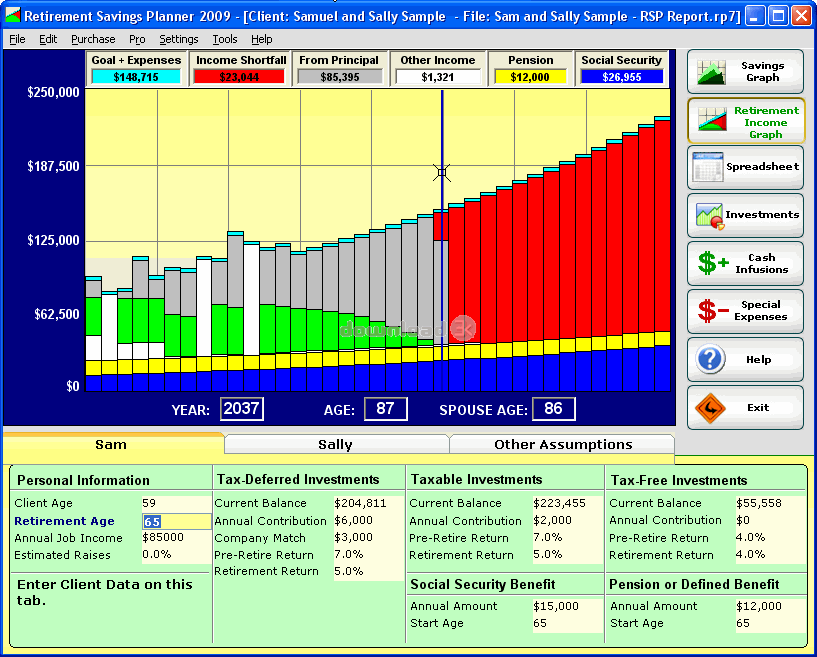

Income Planning Software

SIPS Retirement Planning System is an integrated suite of tools that will help effectively sell your case, improve client retention & increase referrals. Try. Comprehensive financial planning software From simple goals-based assessments to advanced retirement income scenarios and estate planning, NaviPlan equips. Top 5 Financial Planning Software Tools Used by Financial Advisors · 1. MoneyGuidePro · 2. eMoney Pro · 3. RightCapital · 4. eMoney Plus · 5. Asset-Map. Equisoft/plan is an intuitive financial planning solution that provides comprehensive financial portraits. Click to learn more. Use MaxiFi Planner PRO to build lifetime financial plans for your clients. It incorporates the revolutionary Economics Approach to personal financial. Now that you're aware of the things to look out for, here are 10 great financial planning software platforms that you can use as an advisor. Pigment is a fantastic tool for workforce and financial planning. It is extremely customizable, fast, scalable, easy to manage, and friendly for stakeholders. Straightforward and intuitive, the Bucket Bliss™ Advisor software is the perfect income-planning tool for both retirees and those planning for retirement. The MoneyGuide suite of web-based Financial Planning and Retirement Planning Software products create fast and easy Goal Planning, Insurance Needs Analysis. SIPS Retirement Planning System is an integrated suite of tools that will help effectively sell your case, improve client retention & increase referrals. Try. Comprehensive financial planning software From simple goals-based assessments to advanced retirement income scenarios and estate planning, NaviPlan equips. Top 5 Financial Planning Software Tools Used by Financial Advisors · 1. MoneyGuidePro · 2. eMoney Pro · 3. RightCapital · 4. eMoney Plus · 5. Asset-Map. Equisoft/plan is an intuitive financial planning solution that provides comprehensive financial portraits. Click to learn more. Use MaxiFi Planner PRO to build lifetime financial plans for your clients. It incorporates the revolutionary Economics Approach to personal financial. Now that you're aware of the things to look out for, here are 10 great financial planning software platforms that you can use as an advisor. Pigment is a fantastic tool for workforce and financial planning. It is extremely customizable, fast, scalable, easy to manage, and friendly for stakeholders. Straightforward and intuitive, the Bucket Bliss™ Advisor software is the perfect income-planning tool for both retirees and those planning for retirement. The MoneyGuide suite of web-based Financial Planning and Retirement Planning Software products create fast and easy Goal Planning, Insurance Needs Analysis.

Together, the Covisum software suite allows you to build a comprehensive retirement strategy that includes: Social Security, tax efficiency, portfolio. income break points for tax planning opportunities Your software has quickly become indispensable to my practice! John Gay. Frisco Financial Planning. Financial Planning Software, Reimagined. Give Holistic Financial Advice in 10 Min Instead of 10 Hours. An integrated platform of income and retirement planning software — for Social Security Maximization, Retirement Planning, Qualified Planning. Industry-leading financial planning software dedicated to helping people talk about money. Robust solutions for advisors, planners, RIAs, and others. A solution to manage planned spending, unplanned spending, and Roth conversions during retirement. Integrates with your existing planning tools and systems to. Covisum is your partner in conquering the hurdles of being a financial planner. Our cutting-edge software empowers you to create impactful retirement. Transparent, easy-to-use, and highly flexible financial planning software for Canadian Financial Advisors & Planners. At $, this planner allows you to create a customized and comprehensive financial plan for before and after retirement. It includes information on inflation. MaxiFi analyzes your financial future. It calculates a spending, saving and insurance plan to maintain and protect your living standard for life. Retirement Income Platform, Personalize Advice For Pre and In Your current financial planning software. Income Solver fills the GAP – to. Simplify Financial Planning. Be the financial advisor that goes above and beyond for ideal clients looking for a partner to help with their financial goals. Why get stressed when the Go Wealth Pro online financial planning software is there to make life easier. Our Free goals based financial planning software. WealthTrace is the only retirement planning software that looks at each individual investment holding and uses that information to make the most accurate. I'm looking for apps that can consolidate financial accounts and allow me to forecast my finances using custom assumptions. Simulate your financial future. Modern financial and retirement planning tools to plan for early retirement, financial independence, and more. A Lab is a guided online experience that helps you create a customized financial plan focused on your expectations, concerns, and goals. It gives you a chance. Schwab's financial planning tools can help you get the answers you need to your investing questions covering everything from how much you need to retire. From interactive retirement planning and tax-efficient distribution to student loan management, we simplify the complexity of financial planning.

How Much Do You Need To Buy Your First Home

However, the average down payment in the U.S. is about 6% of the cost of a house. There are also USDA loans, which are low-interest loans that don't require a. Borrowing money to purchase a home is a complex process. While working through the home buying process you will need to at least involve a mortgage. For FHA loans, a down payment of % is required for maximum financing. So for the same $, home, you would need to come up with at least $17, How much can I afford to spend on a new home? · Current expenses: Your monthly living expenses; Car payments; Other loan payments; Other monthly bills or regular. You may qualify for a home loan with as little as 3% down with our Standard Agency or Dreamaker loan options. See affordable loans. You must have an acceptable credit history with a minimum credit score of and generally, you should plan to use no more than 30 - 33 percent (30 %) of. Do you have 20% of your target purchase price available for a down payment? It's common to put 20% down, but many lenders now permit much less, such as AHFA's. As a first-time buyer this will usually come from your savings. Your deposit should be at least 5% or 10% of the price of the home you'd like to buy. The bigger. The first thing to do before buying a house is to consider why you want to be a homeowner. After all, a house is a large purchase and often a long-term. However, the average down payment in the U.S. is about 6% of the cost of a house. There are also USDA loans, which are low-interest loans that don't require a. Borrowing money to purchase a home is a complex process. While working through the home buying process you will need to at least involve a mortgage. For FHA loans, a down payment of % is required for maximum financing. So for the same $, home, you would need to come up with at least $17, How much can I afford to spend on a new home? · Current expenses: Your monthly living expenses; Car payments; Other loan payments; Other monthly bills or regular. You may qualify for a home loan with as little as 3% down with our Standard Agency or Dreamaker loan options. See affordable loans. You must have an acceptable credit history with a minimum credit score of and generally, you should plan to use no more than 30 - 33 percent (30 %) of. Do you have 20% of your target purchase price available for a down payment? It's common to put 20% down, but many lenders now permit much less, such as AHFA's. As a first-time buyer this will usually come from your savings. Your deposit should be at least 5% or 10% of the price of the home you'd like to buy. The bigger. The first thing to do before buying a house is to consider why you want to be a homeowner. After all, a house is a large purchase and often a long-term.

The down payment can vary, depending on the loan product, from 3% to 20% or more. Putting less than 20% down will typically require you to pay for private. Borrowing money to purchase a home is a complex process. While working through the home buying process you will need to at least involve a mortgage. You should be able to comfortably pay your full mortgage payment (including taxes and insurance) each month. But you'll also likely need money up front for a. 8 Months Out – Figure out how much house you can afford A general rule of thumb is to avoid taking on a monthly mortgage payment that's more than 28% of your. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Putting 20% down on a home is ideal, but first time home buyers can use these tips to make a smart home purchase without a large down payment. The down payment requirement is equal to a percentage of the cost of the property and can vary based on the type of loan you receive. For example, if a home. Requirements to buy a house · A good credit score. Lenders typically look for a score above · Ample funds for a down payment. Most mortgage loan programs. You can get a loan, worth up to 5% of the home's value, to help with your down payment and closing costs. · A minimum credit score of is required. · It's. Conventional and FHA loans allow you to buy a home with a down payment under %, and FHA loans have low credit score minimums. Other loans, like USDA and VA. How Much Money Do I Need to Put Down on a Home? You'll need to put down at least 20% on a conventional home loan. That is the minimum that most lenders want. Buying Your New Home: Savings and Expectations Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account. How much down payment for a first-time home buyer in North Carolina? The “minimum” down payment for a conventional loan requires a 3% down payment with a. As a first-time buyer this will usually come from your savings. Your deposit should be at least 5% or 10% of the price of the home you'd like to buy. The bigger. Follow the 8 Steps below to make the home-buying process a little easier! CHFA can help with financing. We offer year, fixed-rate mortgages with below-. Buying your first home in RI? Let RIHousing lead you through homebuyer education, mortgage programs, and lender options to the home of your dreams. Figure out how much house you can afford and want to afford. Lenders look for a total debt load of no more than 43% of your gross monthly income (called the. CalHFA understands that buying a home is a huge responsibility. Before you leap into all of the benefits of homeownership, you should get prepared first. Take Advantage of Free Home Buying Seminars and Classes · Determine How Much Home You Can Afford · Check Your Credit Report and Score · Know the Difference Between. A down payment is the amount of money you must bring to the table when you purchase a home. Banks will not lend you % of the amount needed to purchase a home.

What Is A Typical Auto Loan Rate

Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. For used cars, the average was %. Improving your credit score isn't the only way to get a better car loan rate. You could also: Order your credit report. Capital One quoted us % and dealer offered % — told dealer they advertised // on their website — they changed their offer to us. Auto Loans ; New & Used Auto Loan · months ($20K min), % ; College Auto Loan, months, % ; New & Used Motorcycle Loan, months, % ; New. For a month loan: · The monthly payment comes out to be $ with an interest rate of percent. · With the added interest payments, you'll be paying a. Average New Car Interest Rates ; Nov , %, % ; Aug , %, % ; May , %, % ; Feb , %, %. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. The average ranges from 3% to % for new cars—partly because new car buyers tend to have better-than-average credit. But the average used car loan interest. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. For used cars, the average was %. Improving your credit score isn't the only way to get a better car loan rate. You could also: Order your credit report. Capital One quoted us % and dealer offered % — told dealer they advertised // on their website — they changed their offer to us. Auto Loans ; New & Used Auto Loan · months ($20K min), % ; College Auto Loan, months, % ; New & Used Motorcycle Loan, months, % ; New. For a month loan: · The monthly payment comes out to be $ with an interest rate of percent. · With the added interest payments, you'll be paying a. Average New Car Interest Rates ; Nov , %, % ; Aug , %, % ; May , %, % ; Feb , %, %. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. The average ranges from 3% to % for new cars—partly because new car buyers tend to have better-than-average credit. But the average used car loan interest. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %.

What is the average interest rate on a car loan and what is a good interest rate for a car loan? Most Toyota interest rates can run between % and %. Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. Car loans usually have APRs between 3% and 7%, while personal loans have a much bigger range of possible rates, at 6% to 36%. Another major difference between. Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of %. Refinance. Rate and loan amount subject to credit approval. Minimum APR is %. Maximum APR is %. If you change your payment method to coupon at any time, your. New/Used Auto financing available up to % Loan to Value Representative Example: Financing $25, with no down payment at % for 60 months, payment. Auto Loan Interest Rates. Auto loan interest rates change daily and vary What Is the Average Interest Rate on a Car Loan if the Buyer Has Bad Credit? What is a good APR for a car loan with my credit score and desired vehicle? If you have excellent credit ( or higher), the average auto loan rates are Average Interest Rates for Car Loans with Bad Credit ; Prime (), %, % ; Nonprime (), %, % ; Subprime (), %, % ; Deep. Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit · , %, %, % ; Average. July Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. Compare auto loan rates in August ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Explore car loan rates ; New/Used Cars, and newer models, Up to 63 months, As low as % ; New/Used Cars, and newer models, 64 to 75 months, As low as. Average Used Auto Loan Rates in July ; Credit Score, Interest Rate ; or higher, % ; , % ; , % ; , %. Rates as of Aug 23, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Current vehicle loan rates ; Includes cars, pickup trucks, SUVs, etc. New · 72 Month (6-year), % ; Includes cars, pickup trucks, SUVs, etc. · years old, New Car Average Finance Rate at Auto Finance Companies (DISCONTINUED). Percent, Monthly, Not Seasonally AdjustedJun to Jan (). Add to Data. Auto loan delinquency rates are up compared to last year. % of outstanding auto debt was at least 90 days late in the first quarter of , according to the. The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles.

How Much For A Sleeve Gastrectomy

The average cost of gastric sleeve surgery is upward of $10, This procedure (also called gastric sleeve resection, sleeve gastrectomy, vertical sleeve. Self-pay prices ; Biliopancreatic diversion with duodenal switch (BPD/DS): $18, ; Roux-en-Y gastric bypass: $16, ; Sleeve gastrectomy: $12, My hospital sent an estimate for their portion of the procedure (not including surgeon's office fees) and it was over $36K without insurance. Sleeve Gastrectomy Pricing · Total surgery cost = $12, · Total surgery cost = $14, · *Self Pay Patients · Important Conditions · Locations · Patient. Jet Medical Tourism offers gastric bypass surgery at a cost of $5, This procedure is more intricate compared to gastric sleeve surgery but could be an ideal. On average, the procedure can cost between $10, and $20, in the United States. This cost includes pre-operative evaluations, the surgery. In the U.S., gastric sleeve surgery generally ranges between $9, and $27, This price includes: Surgeon Fees: The fees charged by the. Also, too much weight loss can leave you with sagging skin. Both issues often need more surgery. Over time, you may also have some trouble absorbing certain. I used Alabama Surgical Associates in Huntsville - I paid $10, for outpatient sleeve surgery (my insurance doesn't cover anything weight loss. The average cost of gastric sleeve surgery is upward of $10, This procedure (also called gastric sleeve resection, sleeve gastrectomy, vertical sleeve. Self-pay prices ; Biliopancreatic diversion with duodenal switch (BPD/DS): $18, ; Roux-en-Y gastric bypass: $16, ; Sleeve gastrectomy: $12, My hospital sent an estimate for their portion of the procedure (not including surgeon's office fees) and it was over $36K without insurance. Sleeve Gastrectomy Pricing · Total surgery cost = $12, · Total surgery cost = $14, · *Self Pay Patients · Important Conditions · Locations · Patient. Jet Medical Tourism offers gastric bypass surgery at a cost of $5, This procedure is more intricate compared to gastric sleeve surgery but could be an ideal. On average, the procedure can cost between $10, and $20, in the United States. This cost includes pre-operative evaluations, the surgery. In the U.S., gastric sleeve surgery generally ranges between $9, and $27, This price includes: Surgeon Fees: The fees charged by the. Also, too much weight loss can leave you with sagging skin. Both issues often need more surgery. Over time, you may also have some trouble absorbing certain. I used Alabama Surgical Associates in Huntsville - I paid $10, for outpatient sleeve surgery (my insurance doesn't cover anything weight loss.

How much does a Gastric Sleeve or a Gastric Bypass cost? The cost of most weight loss procedures is FIXED and will not vary from patient to patient. Some. Cost of gastric sleeve is reduced for a limited time, gastric sleeve surgery from $ (including GST). Enquire now to discuss options. much more. Home · Treatments · Sleeve gastrectomy. Sleeve gastrectomy. Overview A sleeve gastrectomy (also known as a gastric sleeve procedure) is a. How Much Does Vertical Sleeve Gastrectomy Cost in Oregon? · The average cost of Vertical Sleeve Gastrectomy in the United States is: $19, before insurance. We are a private Weight Loss Surgery clinic & our surgeons work outside of RAMQ (non participating physicians). This means that patients must pay all costs. Sleeve gastrectomy is a surgical weight-loss procedure that involves removing about 80% of the stomach, leaving a tube-shaped stomach about the size and shape. The price range for sleeve gastrectomy is $9, to $14,, including expenses for anesthesia, the hospital facility, the surgeon, pre-op tests and X-rays, and. If you are covered by Medicare or private health insurance, the one-off up-front fee of $3, applies whether you choose to have surgery, whether it's lap band. Pricing | Weight Loss Surgery Experts through the use of Lap Band, Gastric Sleeve and Gastric Bypass at Texas Bariatric Specialists. The word “gastrectomy” means removal of part or all of your stomach. The gastric sleeve operation removes about 80% of your stomach, leaving behind a tubular “. Gastric sleeve surgery, also known as VSG (vertical sleeve gastrectomy) is a type of bariatric surgery that can cost over $20, in the United States. This. Total package cost $19, · After Medicare rebate, approx. $18, · Inclusion: theatre and private hospital fee up to 2 nights · Additional costs. pathology and. In many severely obese patients who are high-risk surgery candidates, the procedure is used as stage one of a two-stage approach to weight loss. After the. The rate of weight loss depends on several factors, including your baseline weight, the weight that has been lost thus far, the type of surgery, activity. How much weight will I lose after the Gastric Sleeve? · The first 2 weeks: pounds; most patients lose about one pound a day · The first 3 months: % of. Did your insurance deny Weight Loss Surgery? · I have Insurance. · Gastric Sleeve Self Pay · Our special self-pay price of $11, for sleeve gastrectomy includes. Situation #1: No Health Insurance Coverage (cash pay) · Laparoscopic Adjustable Gastric Band (LAGB)- $8, · Laparoscopic Roux-en-Y Gastric Bypass (LRnYGB) –. The typical fees and costs shown below are for people with Medicare and who have private health insurance for the procedure. According to the Obesity Coverage, the average cost of a surgery has dropped to approximately $17, and according to Obesity Reporter, the average cost.

Ghsi Stock News

Volatile ride for Guardion Health Sciences Inc. stock price on Thursday moving between $ and $ (Updated on Aug 29, ) · GHSI Signals & Forecast. You can buy or sell GHSI and other ETFs, options, and stocks. Sign up for a Robinhood brokerage account to buy or sell GHSI stock and options commission-free. Guardion Health Sciences Inc GHSI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/23/24 · 52 Week Low Guardion Health Sciences Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Get Guardion Health Sciences Inc (kolarboat.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. GHSI News ; Guardion Health Sciences reports Q1 results · Mon, May 13 ; Molecular Templates, Acorda Therapeutics, MyMD Pharmaceuticals among healthcare movers · Tue. GHSI (GHSI) reported Q2 earnings per share (EPS) of -$, missing estimates of -$ by %. In the same quarter last year, GHSI's earnings per. What is the current stock price of Guardion Health Sciences (GHSI)?. The current stock price of Guardion Health Sciences (GHSI) is $ as of August 30, View Guardion Health Sciences, Inc. GHSI stock quote prices, financial information, real-time forecasts, and company news from CNN. Volatile ride for Guardion Health Sciences Inc. stock price on Thursday moving between $ and $ (Updated on Aug 29, ) · GHSI Signals & Forecast. You can buy or sell GHSI and other ETFs, options, and stocks. Sign up for a Robinhood brokerage account to buy or sell GHSI stock and options commission-free. Guardion Health Sciences Inc GHSI:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/23/24 · 52 Week Low Guardion Health Sciences Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Get Guardion Health Sciences Inc (kolarboat.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. GHSI News ; Guardion Health Sciences reports Q1 results · Mon, May 13 ; Molecular Templates, Acorda Therapeutics, MyMD Pharmaceuticals among healthcare movers · Tue. GHSI (GHSI) reported Q2 earnings per share (EPS) of -$, missing estimates of -$ by %. In the same quarter last year, GHSI's earnings per. What is the current stock price of Guardion Health Sciences (GHSI)?. The current stock price of Guardion Health Sciences (GHSI) is $ as of August 30, View Guardion Health Sciences, Inc. GHSI stock quote prices, financial information, real-time forecasts, and company news from CNN.

View Guardion Health Sciences (GHSI) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. You've viewed Zen Score for 10/10 free stocks. Upgrade to Premium to see how GHSI scored across 33 valuation, financial, forecast, performance, and dividend due. GHSI Price Returns ; YTD, % ; , % ; , % ; , % ; , %. Guardion Health Sciences Announces Financial Results for the Year Ended December 31, , 03/29 , kolarboat.ru ; Why Is Guardion Health (GHSI) Stock. Common Stock (GHSI) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stay ahead with Nasdaq. The current price of GHSI is $ The 52 week high of GHSI is $ and 52 week low is $ When is next earnings date of Guardion Health Sciences Inc(GHSI)?. Guardion Health Sciences (GHSI) is seeing a massive spike in its stock on Wednesday despite a lack of news concerning the company. Guardion Health Sciences Inc is listed in the Pharmaceutical Preparations sector of the NASDAQ with ticker GHSI. The last closing price for Guardion Health. News ; OPEN. ; PREV. CLOSE. ; VOLUME. , ; MARKET CAP. M ; DAY RANGE · GHSI Guardion Health Sciences · High. · Low. · Volume. K · Open. · Pre Close. · Turnover. K · Turnover Ratio. % · P/E (Static). GHSI Stock Overview ; 52 Week Low, US$ ; Beta, ; 11 Month Change, % ; 3 Month Change, % ; 1 Year Change, %. GHSI has a High Technical Rating by Nasdaq Dorsey Wright. Discover why technical analysis matters. $ + +%. Aug 26, AM ET. Guardion Health Sciences (NASDAQ:GHSI) Stock Quotes, Forecast and News Summary ; Close, - ; Volume / Avg. K / K ; Day Range, - - - ; 52 Wk Range, -. You've viewed Zen Score for 10/10 free stocks. Upgrade to Premium to see how GHSI scored across 33 valuation, financial, forecast, performance, and dividend due. View live Guardion Health Sciences, Inc. chart to track its stock's price action. Find market predictions, GHSI financials and market news. Guardion Health Sciences (GHSI) Stock Price & Analysis ; Average Volume (3M)K ; Market Cap. $M ; Enterprise Value$M ; Total Cash (Recent Filing)$M. GHSI ; Low/Hi: - Week: · Volume: 1, VWAP: ; Market Cap: M · P/E Ratio: P/Sales: P/Book Value: ; Dividend: Div Yield: -. Earnings. Get the latest Guardion Health Sciences Inc. (GHSI) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Track Guardion Health Sciences Inc (GHSI) Stock Price, Quote, latest community messages, chart, news and other stock related information. The latest Guardion Health Sciences stock prices, stock quotes, news, and GHSI history to help you invest and trade smarter.

1 2 3 4 5